SummaryThere’s a lot to think about when comparing and choosing accounting software for your business, and not only the monthly cost. It’s tempting to go for the cheapest plan, but this could mean https://www.personal-accounting.org/retained-earnings-calculation/ having to pay extra for the add-on features your business needs. QuickBooks is Intuit’s general accounting software, while QuickBooks Online (QBO) is specifically the cloud-based service.

Best Accounting Software for Small Businesses

Before joining NerdWallet in 2020, Sally was the editorial director at Fundera, where she built and led a team focused on small-business content and specializing in business financing. If you need accounting tools but don’t know where to start (or can’t afford to pay for them yet), Wave is likely your best choice. All your data is automatically backed up to the cloud and synced across all your devices, so any changes made on the move will be updated when you next login in your laptop or desktop. This includes snapping pictures of your receipts and uploading them via your phone. FreshBooks charges $17 per month and QuickBooks charges $30 per month).

Account Information

- This makes it a versatile tool for small businesses that need to streamline their operations.

- Given that there are several invoicing software on the market, it’s worth putting in some time to research your options before choosing one for your business.

- One of the things that sets Zoho apart is its focus on meeting business needs at every stage of growth.

- Xero, FreshBooks and QuickBooks all offer 30-day free trials and extensive features for online support, including a live chat, email support and a knowledge base.

- Both services have plenty to offer, but in the end, Xero has more integrations than QuickBooks.

Today’s leading accounting platforms offer standard security features like data encryption, secure credential tokenization and more. While human error will always play some role in security breaches, you can be confident in your accounting platform when it comes to keeping your information safe. Given that there are several invoicing software on the market, it’s worth putting in some time to research your options before choosing one for your business. Both QuickBooks and Xero are excellent accounting systems for small businesses, and customer reviews reflect how well the software providers understand their audiences.

A/R: QuickBooks Online Wins

You can also sync your bank accounts for automatic tracking and reconciliation. However, keep in mind that the entry-level Early plan only supports 20 invoices and five bills per month, so if you regularly exceed that, then you’ll need to upgrade. All of the QuickBooks plans allow you to create unlimited invoices and quotes and customize them to reflect your company branding. QuickBooks also allows you to accept payments from debit or credit cards, as well as ACH payments, Apple Pay, PayPal and Venmo.

Integrations: Tie

Both Xero and QuickBooks Online offer excellent integration with hundreds of apps. For those moving their small business’ accounting over from another application, you can import data into QuickBooks Online using the Import Data function. Xero’s main entry screen uses a menu bar at the top of the screen for access to system functions. This pared-down menu makes it easy for new users to find their way around the application without too much trouble. You’ll rarely be asking yourself how to use QuickBooks Online as they offer plenty of guidance throughout the application; users can click on the question mark anytime they need assistance. Xero and QuickBooks Online both offer a ton of features all designed for small business owners.

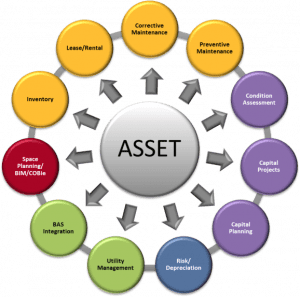

Learn more about our full process and see who our partners are here. Yes, both have a fixed asset manager that allows you to track fixed assets and calculate depreciation. Fixed asset accounting is part of https://www.online-accounting.net/ all Xero’s plans, while it’s offered only in the most expensive plan of QuickBooks Online—Advanced. This includes the availability of integrations for payroll, time tracking, and receiving e-payments.

Here are NerdWallet’s picks for the best small-business accounting software, including why we selected each product, monthly price details and features checklists for easy product comparisons. We’ve also included a couple of solutions that nearly made our list and a few products you can skip. We also recommend Xero if you’re seeking project profitability data alongside fiscal year wikipedia superior bill pay and expense management features. We found the platform’s profitability tools to be highly user-friendly. Your team’s tracked time and expenses power your profitability reports and give you all the necessary information to adjust inputs and minimize costs. This frees up the cash you need to make the timely bulk payments that Xero facilitates.

Xero and QuickBooks are both great accounting software options for small businesses. They both offer a wide range of features, an easy-to-use interface and competitive pricing. While searching for accounting software, you might also come across something called QuickBooks Online Essentials.

The software must have enough reports that can be generated with a few clicks. Moreover, we’d also like to see customization options to enable users to generate reports based on what they want to see. QuickBooks Online takes the lead because it’s generally easier to use than Xero. While Xero is easier to set up, QuickBooks has a more intuitive and customizable dashboard and has time-saving features. For instance, QuickBooks Online allows you to add an inventory item from the invoicing screen, something you can’t do with Xero.

It has comparable invoicing features, but lacks an audit trail and doesn’t integrate with third-party apps. Xero vastly outperforms QuickBooks in its fixed asset management tools. With QuickBooks, you can record the purchase of a fixed asset, but with Xero, you can track fixed assets, calculate and track their depreciation, and much more. Xero also has a more robust tool for tracking project profitability, giving you access to real-time reports. Additionally, Xero is a better choice for international businesses needing multicurrency support. Xero also offers mobile receipt capture through its Xero Me mobile app (previously called the Xero Expenses app), though you’ll need to upgrade to the Established plan to claim expenses.

It helps you follow basic accounting principles so that you can keep your books up to date and in order, which is especially important come tax season. Most software uses double-entry accounting, meaning it factors in assets, liabilities and equity, in addition to revenue and expenses. Some have to track inventory, payroll, benefits packages, numerous points of overhead, subcontractors, partnership deals — and so on and so forth.

To compare QuickBooks vs. Xero accounting, we consulted product documentation and user reviews. We considered features such as invoicing, billing, payments, expense tracking, mileage tracking, project and time tracking and inventory management. We also weighed factors such as pricing, user experience, customer service and integrations. Ironically, we don’t recommend this plan to freelancers due to its lack of tools, even though we do recommend QuickBooks as the best accounting software for the self-employed. On top of the shared features listed above, both QuickBooks and Xero have inventory management tools.

We also liked Xero’s built-in integrations with the payment processor Stripe, the CRM HubSpot, the email marketing platform Mailchimp and the e-commerce platform Shopify. Business News Daily provides resources, advice and product reviews to drive business growth. Our mission is to equip business owners with the knowledge and confidence to make informed decisions. As part of that, we recommend products and services for their success. Xero and QuickBooks Online are robust accounting software programs and, in our case study, both prove why they’re the leading tools in the industry. They may have almost the same features, but each has its own strengths and drawbacks.

Xero vs QuickBooks for Accounting Features, Fees, Support

Xero vs QuickBooks for Accounting Features, Fees, Support

SummaryThere’s a lot to think about when comparing and choosing accounting software for your business, and not only the monthly cost. It’s tempting to go for the cheapest plan, but this could mean https://www.personal-accounting.org/retained-earnings-calculation/ having to pay extra for the add-on features your business needs. QuickBooks is Intuit’s general accounting software, while QuickBooks Online (QBO) is specifically the cloud-based service.

Best Accounting Software for Small Businesses

Before joining NerdWallet in 2020, Sally was the editorial director at Fundera, where she built and led a team focused on small-business content and specializing in business financing. If you need accounting tools but don’t know where to start (or can’t afford to pay for them yet), Wave is likely your best choice. All your data is automatically backed up to the cloud and synced across all your devices, so any changes made on the move will be updated when you next login in your laptop or desktop. This includes snapping pictures of your receipts and uploading them via your phone. FreshBooks charges $17 per month and QuickBooks charges $30 per month).

Account Information

Today’s leading accounting platforms offer standard security features like data encryption, secure credential tokenization and more. While human error will always play some role in security breaches, you can be confident in your accounting platform when it comes to keeping your information safe. Given that there are several invoicing software on the market, it’s worth putting in some time to research your options before choosing one for your business. Both QuickBooks and Xero are excellent accounting systems for small businesses, and customer reviews reflect how well the software providers understand their audiences.

A/R: QuickBooks Online Wins

You can also sync your bank accounts for automatic tracking and reconciliation. However, keep in mind that the entry-level Early plan only supports 20 invoices and five bills per month, so if you regularly exceed that, then you’ll need to upgrade. All of the QuickBooks plans allow you to create unlimited invoices and quotes and customize them to reflect your company branding. QuickBooks also allows you to accept payments from debit or credit cards, as well as ACH payments, Apple Pay, PayPal and Venmo.

Integrations: Tie

Both Xero and QuickBooks Online offer excellent integration with hundreds of apps. For those moving their small business’ accounting over from another application, you can import data into QuickBooks Online using the Import Data function. Xero’s main entry screen uses a menu bar at the top of the screen for access to system functions. This pared-down menu makes it easy for new users to find their way around the application without too much trouble. You’ll rarely be asking yourself how to use QuickBooks Online as they offer plenty of guidance throughout the application; users can click on the question mark anytime they need assistance. Xero and QuickBooks Online both offer a ton of features all designed for small business owners.

Learn more about our full process and see who our partners are here. Yes, both have a fixed asset manager that allows you to track fixed assets and calculate depreciation. Fixed asset accounting is part of https://www.online-accounting.net/ all Xero’s plans, while it’s offered only in the most expensive plan of QuickBooks Online—Advanced. This includes the availability of integrations for payroll, time tracking, and receiving e-payments.

Here are NerdWallet’s picks for the best small-business accounting software, including why we selected each product, monthly price details and features checklists for easy product comparisons. We’ve also included a couple of solutions that nearly made our list and a few products you can skip. We also recommend Xero if you’re seeking project profitability data alongside fiscal year wikipedia superior bill pay and expense management features. We found the platform’s profitability tools to be highly user-friendly. Your team’s tracked time and expenses power your profitability reports and give you all the necessary information to adjust inputs and minimize costs. This frees up the cash you need to make the timely bulk payments that Xero facilitates.

Xero and QuickBooks are both great accounting software options for small businesses. They both offer a wide range of features, an easy-to-use interface and competitive pricing. While searching for accounting software, you might also come across something called QuickBooks Online Essentials.

The software must have enough reports that can be generated with a few clicks. Moreover, we’d also like to see customization options to enable users to generate reports based on what they want to see. QuickBooks Online takes the lead because it’s generally easier to use than Xero. While Xero is easier to set up, QuickBooks has a more intuitive and customizable dashboard and has time-saving features. For instance, QuickBooks Online allows you to add an inventory item from the invoicing screen, something you can’t do with Xero.

It has comparable invoicing features, but lacks an audit trail and doesn’t integrate with third-party apps. Xero vastly outperforms QuickBooks in its fixed asset management tools. With QuickBooks, you can record the purchase of a fixed asset, but with Xero, you can track fixed assets, calculate and track their depreciation, and much more. Xero also has a more robust tool for tracking project profitability, giving you access to real-time reports. Additionally, Xero is a better choice for international businesses needing multicurrency support. Xero also offers mobile receipt capture through its Xero Me mobile app (previously called the Xero Expenses app), though you’ll need to upgrade to the Established plan to claim expenses.

It helps you follow basic accounting principles so that you can keep your books up to date and in order, which is especially important come tax season. Most software uses double-entry accounting, meaning it factors in assets, liabilities and equity, in addition to revenue and expenses. Some have to track inventory, payroll, benefits packages, numerous points of overhead, subcontractors, partnership deals — and so on and so forth.

To compare QuickBooks vs. Xero accounting, we consulted product documentation and user reviews. We considered features such as invoicing, billing, payments, expense tracking, mileage tracking, project and time tracking and inventory management. We also weighed factors such as pricing, user experience, customer service and integrations. Ironically, we don’t recommend this plan to freelancers due to its lack of tools, even though we do recommend QuickBooks as the best accounting software for the self-employed. On top of the shared features listed above, both QuickBooks and Xero have inventory management tools.

We also liked Xero’s built-in integrations with the payment processor Stripe, the CRM HubSpot, the email marketing platform Mailchimp and the e-commerce platform Shopify. Business News Daily provides resources, advice and product reviews to drive business growth. Our mission is to equip business owners with the knowledge and confidence to make informed decisions. As part of that, we recommend products and services for their success. Xero and QuickBooks Online are robust accounting software programs and, in our case study, both prove why they’re the leading tools in the industry. They may have almost the same features, but each has its own strengths and drawbacks.

Catégorie

Lire aussi

Gambling establishment Mr Wager : Le Meilleur Web site de Gambling enterprise en ligne au Canada

Unser ultimative Craps Anleitung 888 Spielbank

Permit and you can Policy: In the All of us Mr Bet Gambling enterprise Canada

Book of Ra Slot: 50 Freispiele ohne Einzahlung alleinig

9 Better Mastercard Casinos online inside the 2024 for Secure Gaming

Autres articles

Comment choisir la meilleure formation en santé pour améliorer la qualité des soins ?

Dans le secteur médical, le choix d’une formation adaptée représente un facteur déterminant pour garantir l’excellence des soins. La sélection

Gambling establishment Mr Wager : Le Meilleur Web site de Gambling enterprise en ligne au Canada

Blogs Casino Rich Reels no deposit bonus: Nettikasino Mr Bet Secure commission handling You’ll get into a great qualifying position

Unser ultimative Craps Anleitung 888 Spielbank

Content Bankroll-Management: Diese beste Masterplan – Top-Online-Casino, das Google Play-Einzahlungen akzeptiert Come and Don’t come Craps damit echtes Geld zum

Permit and you can Policy: In the All of us Mr Bet Gambling enterprise Canada

Articles Casino Windfall casino | Player’s winnings haven’t started acquired yet. Withdrawals Battle away from Revolves Tournament Bonuses We’ll along

Book of Ra Slot: 50 Freispiele ohne Einzahlung alleinig

Content Bitcoin -Casino -Boni: Book of Ra Tricks ferner Tipps Ähnliche Slots Mobile vs. Desktop Erglimmen als nächstes beim Freispiel

9 Better Mastercard Casinos online inside the 2024 for Secure Gaming

Content Casino Doublestar review | In control Betting at the Bitcoin Casinos Becoming Secure and safe While playing Online slots